SRI LANKA: If I was the Minister of Finance

An article from Chandra Jayaratne forwarded by the Asian Human Rights Commission

By Chandra Jayaratne

If I was the Minister of Finance, I will seek the concurrence of the President, the Prime Minister and the Cabinet Colleague to structure the 2022 National budget on the undernoted Core Change Management Principles , Key Action Strategies and Proposals;

Core Change Management Principles

Recognizing that 6.9 million voters endowed the government with power in the fervent hope of “Prosperity and Splendour”, and as we owe to all citizens of today and the newer generations yet unborn, to deliver on such promises, it is time to have the “Courage to be Different” and govern;

• Abandoning blind hope, mystical and astrological beliefs, not waiting for the good times to emerge and drive the dark clouds of the three pronged risks of the pandemic, fiscal challenges and debt overhang;

• Discarding “Road Maps” that depend on selling state assets, hand to mouth existence matching day to day cash flows with committed outflows and reducing the operational freedoms of growth drivers by restrictions and controls; and

• Adopting best practices of governance, risk management and economics, and implement a change management oriented restructure and use this crisis as the way to deliver in the medium term the promises to and hopes of the citizens.

Core Strategies

• With transparency and integrity brief the legislators, the executive and the public at large via a series of public communications and announcements, the gravity of the macro economic crisis and financial stability/solvency challenges facing Sri Lanka in the short term, in the midst of the pandemic associated additional risks (subject to safeguarding that such disclosures will not in any way risk advance/crystallizr a further crisis), due to years of mismanagement by many governing regimes of the past failing year on year to address the twin fiscal and current account deficits;

• Appeal to all legislators, the executive and the public at large, post awareness of the impending crisis and possible consequences, to collectively and with commitment and in the belief that “We Can and We Will Overcome Our Challenges by Our Collective Efforts”, to support the strategic action essential in the difficult few years ahead;

• Reminding all citizens that in the critical period ahead sacrifices will be necessary by all; and assure them that the major share of such sacrifices will be borne by those with capacity to bear; and that a well designed and effectively administered “Safety Net” will protect the interests of the elderly, poor, marginalized and vulnerable segments of society;

• A strong social safety-net,with flexibility and rapid action capability, will be developed, encompassing better design and targeting, to enforce and implement eligibility criteria developed with World Bank assistance for Samurdhi. This strategy will be supported by an early introduction of ICT driven Aadhaar type schemes, Aadhaar Card and associated bank account systems for effective and efficient distribution. A shift from distortionary subsidies to income transfers will provide social protection and will be supported by a biometric identity and thus improve efficiency and reduce leakages;

• Market driven macroeconomic fundamentals will be the way forward, with a single minded focus on agro-industrial exports and services growth, led within a facilitative foreign policy framework, a market friendly consistent policy framework, foreign direct investments, technology transfers and manpower capabilities matching the emerging global opportunities;

• Gradually increasing growth rates of 5-8% commencing from 2022 will be the initial goal. Every attempt will be made to develop possible reform options, including policy and regulatory changes, digitization, fiscal adjustments and factor productivity enhancing other change management restructures. Care will be taken in the implementation to back load some reforms and fiscal adjustments to ensure that the pandemic induced economy is not subjected to growth contractionary fiscal policies upon decreasing government spending and increasing tax revenues;

• Good Governance, Policy Consistency, Rule of Law and Justice and elimination of Waste, Corruption, Money Laundering and Transfer Pricing, will be focused priorities in overcoming the macro-economic and financial stability challenges in the near term;

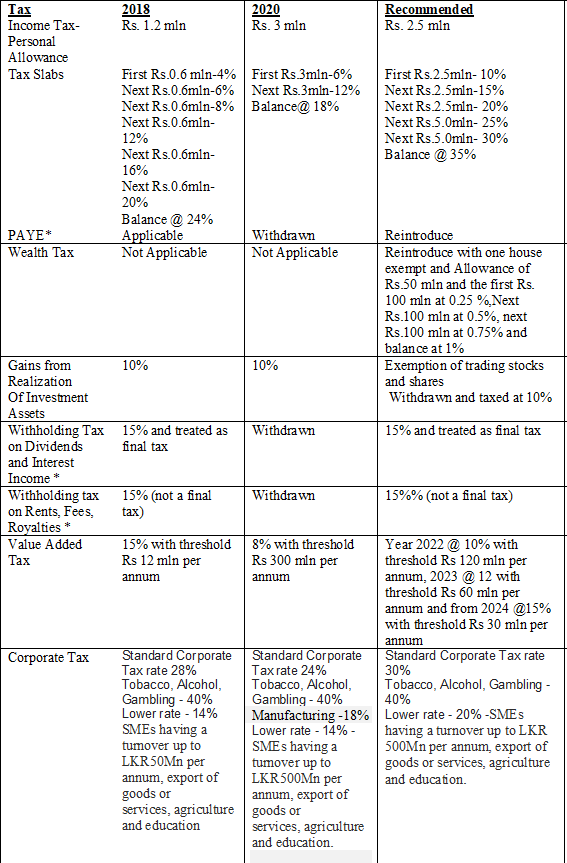

• Take strategic action to gradually increase the revenue to GDP to 12-15% over the next 3 years and enhance it to 18% by year 6;

• Principles of efficiency enhancements, equity where the ability to pay by those with capacity to contribute and bear the brunt of the enhanced taxes will be strictly enforced, with the poor and vulnerable populations being duly sheltered and covered by effective safety nets; simplicity in revenue collection systems will be key. A mix of measures to broaden the tax base and increase tax rates will be deployed with all measures taking account of distributional effects. Over time, the ratio of indirect to direct taxes should move from 80/20 to 60/40. Progressive taxes on both income (including capital gains) and wealth will be levied; with VAT rate increases being phased out; reductions in threshold and reduction in exemptions will be deployed;

• The continuance or selective application of all presently available and newly granted tax holidays and exemptions via strategic projects and Port City operations will be subject to continuous reviews to establish that these deliver above cut off growth, new employment generations, forex and long term cash flow supportive state revenue enhancements;

• Improved tax administration will be key to realizing revenue enhancements. Achieving the full potential of RAMIS, including connecting all revenue collecting agencies to Inland Revenue Department will be an important strategy. It will be necessary to buy back, with regular taxable payment of incentive allowances, the options now enjoyed by revenue agency and other staff members of the state services currently entitled to a share of fines, surcharges and confiscations. Effectively reviewed compulsory asset declarations by revenue agency official will need to be place;

• Set up an Independent Revenue Enforcement Authority with Powers of Prosecution and Recovery of Stolen State Assets and Avoided State Revenues, with two separate divisions (one reviewing all old cases and a case study files /reports) and the other current suspicious financial transactions, money laundering, terrorism financing, crypto currency operations, transfer pricing, serious financial crimes, related party transactions, misuse of beneficial ownership options and illegal offshore wealth accumulations;

• All business entities above defined turnover levels engaged in import/export transactions, local and foreign trading/banking/finance and services would be required to provide the Revenue Enforcement Authority on an annual basis, with transfer pricing audit certificates, related party transaction details and beneficial holding details;

• Within the market based pricing policies, formulae based adjustments will be made to fuel, energy and public transportation prices;

• Every option will be taken to privatize/ monetize non strategic underutilized assets and non performing and unable to turn around state owned commercial entities (only where national security is not compromised);

• National budgets will be developed embedding strict austerity measures, prioritizations and justification assessments on Economy, Efficiency and Effectiveness criteria; change management options with zero based budgeting techniques will be deployed; A process for repeat testing prior to spend authorization of all large ticket discretionary expenditure will be enforced; all spends in excess of Rs. 500 mln per project will be subject to post audits. Strict approval criteria will be apply capital expenditure and any allocations with medium outcome returns and medium priority/risks will be re-phased;

• National resources of the sea, land and air space and all natural resources therein will be commercially leveraged with sustainability and optimization of returns;

• Transparent Requests for Proposals led competitive bidding and diligent evaluation and award processes will be followed for in all major procurements, major projects and monetization of state assets. In the constrained fiscal environment genuine Public Private Partnership modalities of Build Operate Transfer (BOT), Build Transfer (BT), Build Own Operate Transfer (BOOT) and Build Own Operate (BOO) will be pursued, especially for infrastructure development projects. Unsolicited proposals and bids will not be usually entertained and where in exceptions they are pursued, Swiss Challenge modalities will apply.

• Cease all new appointments to the public services and re-deployment with efficiency, effectiveness will be a key focus; introduce prioritized and targeted change management restructures of the public services to improve productivity, efficiency and effectiveness and assure all public servants and those paid on state account in state owned enterprises are deployed with given specific job responsibilities, accountabilities and expected to produce desired outcomes (KPI’s) with oversight supervision by designated superiors;

• Compliance with Fiscal Responsibilities Act and Active Liability Management Act and other targets approved by the Legislature will become accountable objective of the Executive and Public/Regulatory Authorities, with a medium term objective to reduce the Fiscal Deficit to 5% by 2025;

• The National Priority areas will include;

o Pandemic related allocations

o Safety Net allocations

o Health, Nutrition, Child and Elderly Care Allocations

o Education, Human Capability ( Knowledge, Skills, Attitudes and Values) Development aimed at Developing highly skilled and productive workforce meeting investor and development needs, especially regards the Industry 4.0, Emerging Digital and Artificial Intelligence related orking skills

o Investment/Exports ( Goods and Services) Promotion

o Livelihood support and creating new job opportunities, especially targeting bringing in the workforce women and youth

o Energy Security with an increasing share of renewable sources and developing matching battery storage capacities

o Food and Nutrition Security

o Water, Irrigation and Soil Enrichment

o National Security

o Environmental Sustainability and Ecology Preservations

o Port/Airport Development

o Value optimization of Natural and Sea Resources of Sri Lanka focusing on energy and Indian Ocean resources in building a new Blue Economy

o Transportation and Communications

o Early childhood and elderly care

o De-regulation, Digitization and advancing in Ease of Business and Other key Productivity/Quality and Competitive Advantage seeking opportunities

o Research, Innovations, Applied Research & Patent Development

o Disaster readiness

• Sri Lanka to approach the International Monetary Fund and Leading International Investment Banking Specialists for technical and professional assistance support to restructure the external debt obligations pursuing all available options including a moratorium, extending the tenor, hair cut etc. and arranging necessary external financing support under an International Monetary Fund Assistance Programme as the base for such fund raising;

• With an International Monetary Fund Assistance Programme in place and debt sustainably analysis developed, seek Budget support from multilateral funding agencies like World Bank and Asian Development Bank and also bi-lateral partners and their agencies of financial assistance ( China Development Bank/ USAID/ JICA/ EU/ Aus Aid/ CIDA/ MCC etc);

• In the interim pending above revisit and update the Medium Term Debt Management Strategy (2019/23) and pursue the selected path in managing the external debt commitments and once the debt restructure is completed update the strategy once more; and diligently, with commitment implement the revised strategy. Once market access is regained, use Asset Liability Management Act to deploy liability management techniques including buy-backs. Switching, securing zero coupon and green bonds etc

• Acceptance that International Financial Institutions, lenders, creditors investors, rating agencies, and network agencies must be made willing partners in the macroeconomic and debt sustainability management turnaround; and made to feel satisfied that genuine best efforts are being made to successfully turnaround and that all commitments will be collectively honored;

• All subsidies provided in agriculture, fisheries, energy, transportation, essential foods will be removed and pricing be market based with tapering down cash transfers with a sunset date and be extended on a selective basis to those severely impacted and unable to bear the weight of such changes;

• An globally acceptable Trade Policy, removing all anti-export bias in policy stance, including exchange rate inflexibility, para tariffs, non ad-valorem taxes, and shifting away from tariff structure that prevents penetration of global and regional supply chains will be introduced, optimizing trade and services opportunities via trade agreements; along with a Trade facilitations supportive single window in customs to implement WTO Trade Facilitation Agreement; A four band tariff will be introduced with the agreement of the trade associations whist exceptions subject to higher rates and surcharges being minimized;

• All state owned businesses will be required to undergo essential restructures in order that they become free cash-flow neutral by year 3 and positive by year 5; and failing they be subjected to closure or monetization. Business turnarounds and change management restructures will be supported and required changes Implemented with due oversight including agreed “Statements of Intent” developed by the large and fiscal sensitive State Owned Enterprises;

• Implementation of a proactive and data-driven monetary policy, using an inflation targeting as the anchor will be adopted, as the current practices and caps are now challenged by markets. The use of moral suasion and regulatory action warnings and restrictions on the use of market instruments for hedging and forward rates will cease forthwith;

• In order to promote export of goods and services, bring stability to exchange rates and attract value adding foreign direct investments, flexible market driven exchange rates will be a key strategic change, requiring high degree of professional and regulated implementation skills by the Central Bank;

• To promote foreign direct investments, export of goods and services, banking and finance supportive networks, focused attention and strategic action will seek improved sovereign ratings and rankings in leading global assessment indices including Ease of Doing Business, Business Confidence, Corruption Perceptions and High Risk and Other Monitored Jurisdictions;

• Board of Investments, the Export Development Board and the Port City Commission will collectively target Investment promotion with single minded focus in attracting high foreign currency value adding selected sectors and identified companies and entities, including those with opportunities to benefit from existing and planned Trade Agreements and Preferential Trading Regimes available to Sri Lanka;

• The grant of Tax holidays and exemptions will henceforth be limited; and where extended will be subject to regular reviews to establish these deliver above cut off growth, export incomes, new employment generations, introduction of new technology transfers with sustainable value addition, establishment of new niche markets and links to global supply chains, research and Innovation and long term cash flow enriching state revenue. These concessions will need to be administered with heavy fines and even penal sentences where deliberate and fraudulent commercial transactions are evidenced;

• Education, training and skills development initiatives will be aligned to drive growth and employment generation, exploiting country’s dynamic comparative advantages, location, labour and markets access and will be supported with essential investments. Resources will be allocated to develop manpower capability to provide off shore services and employment opportunities to youth by empowering them with high proficiency in English, selected other foreign languages, ICT and readiness with productive capacities and acceptable work ethic;

• Proactively seek significant increases in factor productivity and improvement in quality and efficiency of goods and services produced, especially in the agri-business, fisheries, SME’s and support them with incentives for restructure and in getting linked to local and overseas supply chains;

• Protecting the environment and ecology and protecting and assuring sustainability of national resources will be a key focus;

• Negotiations with stakeholders will be initiated to drastically reduce the number of public holiday including poya holidays (other than for vesak and poson);

• Policy consistency with speedy and effective administration and a high degree of accountability, transparency and diligent follow up will be key drivers of governance;

• A totally non aligned long term value adding foreign relations policy will be in place assuring good relations with all nations; Our missions in foreign countries will be subject to specific objectives, accountabilities and expected to produce desired outcomes (KPI’s)

• Reinforce the autonomy and independence of the Central Bank of Sri Lanka by enacting the 2019 agreed amendments to the Monetary Law Act, along with expanding the Monetary Board to be made up of nine members – the Governor, the three Deputy Governors for Monetary Policy, Financial Stability and Markets and Banking, Chief Economist of CBSL and four external members (Being professionals of high integrity and track record of achievements in Economics, Banking and Finance, Business and Commercial law) appointed by the President on the recommendations of the Constitutional Council. A former Governor or a Deputy Governor of the Central Bank will be appointed as an Independent Advisor to the Finance Minister and such nominee will be an observer (without a vote or right to participate in decision making) in the proceedings of the Monetary Board;

• Based on the best practices of limiting added risks during periods of heightened risks;

*Full organic Agriculture programme be targeted for 2050 and in the interim a hybrid cultivations will be permitted

*Palm oil, Turmeric and other local agro produce cultivations and manufacture ban be deferred till 2030

*Renewable sources based energy generation will be progressed subject to matching distribution capacities and meeting demands without black/brown outs

*Effective Communications with role model leaderships will be committed to take people in to confidence and make them aware of the challenges before the nation and the possible consequences and encourage the practice of extreme austerity measures by all concerned;

Proposals

Revenue Raising Measures

*Supported by quick response directions

Growth Incentives

A State Budget vote Rs 20 billion will be available annually, to offer pre agreed “Start up Costs” reimbursement grants and Success Fees on achievement of set objectives, to promote Consultants, Professionals, Businesses, Universities, Academics, Researchers and Inventors to successfully implement pre approved project proposals, connected with:

• Enhancing factor productivity and generating incremental and sustainable local value addition enhancements of at least Rs. 500 million per annum

• Creating niche export markets for goods and services generating incremental and sustainable local value addition enhancements of at least Rs. 500 million per annum

• Technology transfers, leveraging ICT and digitization, use of artificial intelligence, productivity, quality and manpower training and development engagements generating incremental and sustainable local value addition enhancements of at least Rs. 500 million per annum

• Research and Innovations leading to the registering worldwide patents and setting up businesses capable of realizing incremental and sustainable free cash flow value creations of at least Rs. 100 million per annum

• Business turnarounds and change management restructures generating incremental and sustainable free cash flow value creations of at least Rs. 100 million per annum

• Commercial initiatives that create new ventures, niche markets and manpower capability development yielding sustainably new livelihood options for not less than 1000 persons

Improve Productivity and Value Enhancement of Agro- Fisheries-Livestock Products Supply Chain

Rs 15 billion will be allocated over 3 years as state capital contributions to Private Public Partnership ventures, to be competitively selected, setup and operated with majority private sector shareholdings, to provide Logistical Support to Improve Productivity and Value enhancement of Agro- Fisheries-Livestock Products Supply Chains via:

• Logistical centres in Trincomalee, Dambulla, and Matara offering temperature controlled Storage, sorting, packaging and storage, value added processing, distribution and sales

• Offer end to end supply chain and financings options support for smallholder entrepreneurs including forward contracting, procurement of timely supplies, financing, selling and post harvest distribution assisted via handheld devises leveraging ICT applications

• Productivity and quality enhancement, post harvest losses minimization, risk management, extension and advisory services

• Research and innovation to support sustainable competitive advantage

……………..

The views shared in this article do not necessarily reflect that of the AHRC.